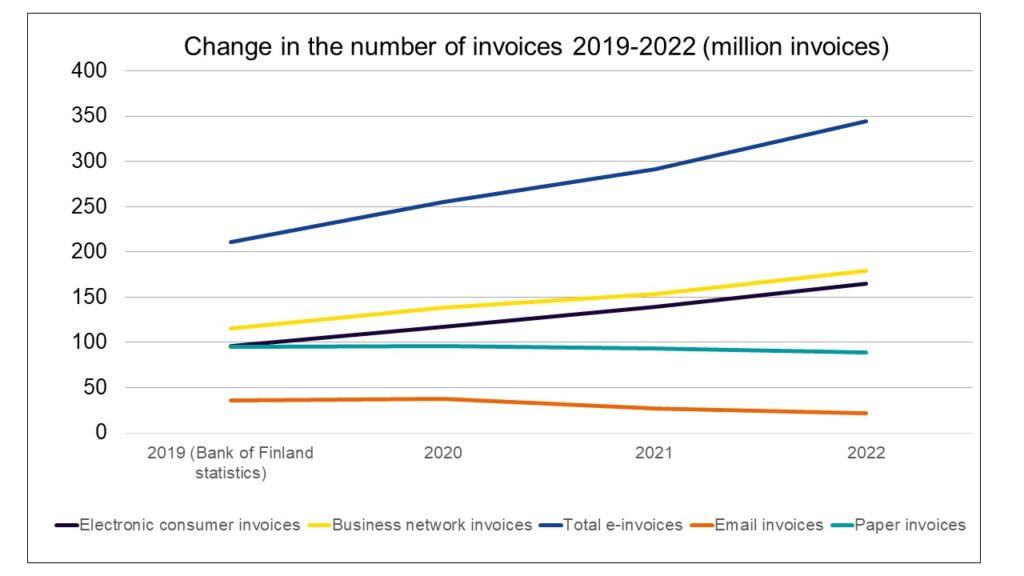

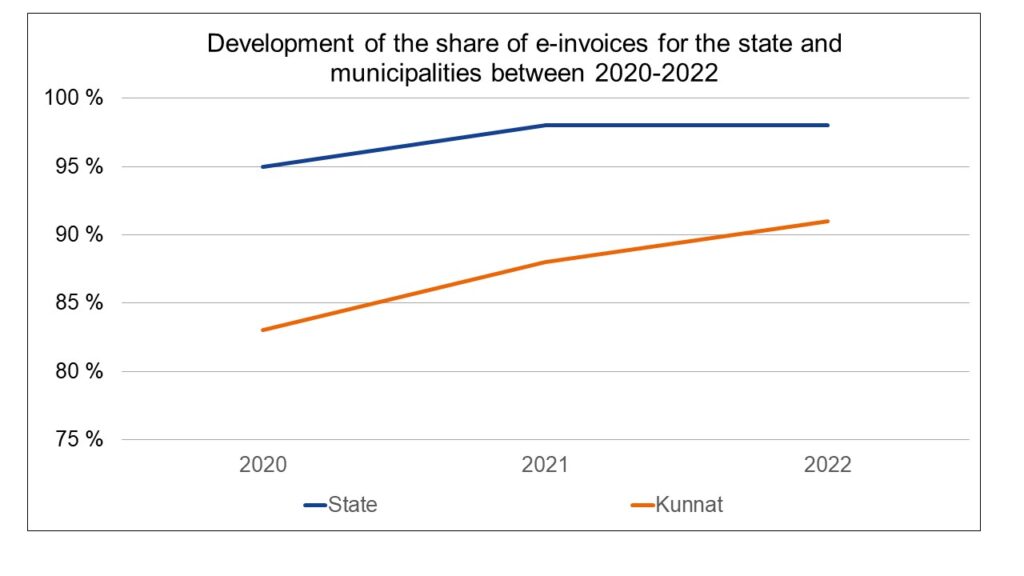

To promote digitalisation, one of the goals of the Real-Time Economy project is to increase the number of e-invoices between organisations to 90 percent by the end of 2023. The goal of Sanna Marin’s government platform for the widespread adoption of e-invoices is also being promoted.

The purpose of the e-invoice metrics is to describe the current situation of e-invoicing and its development in Finland. The metrics monitor the realisation of the Real-Time Economy project’s goal of e-invoicing, and verify the necessary measures to achieve the goal. The metrics were implemented for the first time in 2021 and will be repeated annually during the Real-Time Economy project.

Use of e-invoicing in the public sector

Pursuant to the E-invoicing Act, the public sector must have the ability to receive and process e-invoices compliant to the EN16931 standard (“European Standard”). By law, the public sector must also be able to deliver sales invoices in accordance with the standard.

More about E-invoicing metrics:

Tomi Rusi, specialist, State Treasury

tomi.rusi(at)valtiokonttori